Charlie Munger's No: 1 Mental Model.

The keystone mental model that helps Charlie Munger avoid bad decisions.

How does the wisest guy in the history of investing make good decisions and stay away from the bad ones? The answer to this question may sound too simple that far too many people will not take it seriously.

Charlie Munger and Warren Buffet came up with a framework that became the keystone mental model for all their investment decisions. It’s called “The Circle of Competence”.

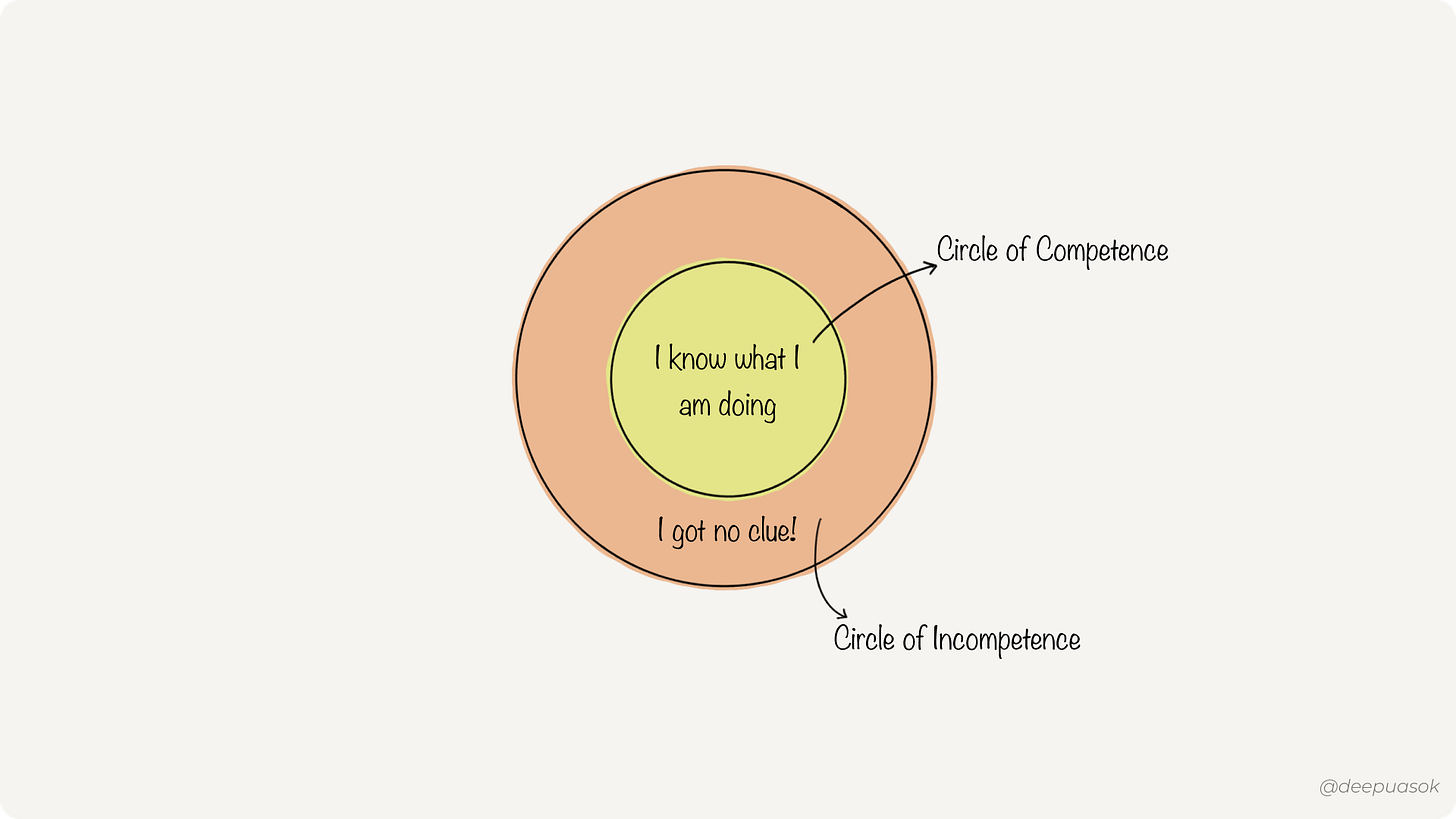

So, what’s the circle of competence? In simple words,” You strive to know what you really know (the circle of competence) and what you don’t really know (the circle of incompetence). And, you avoid big bets outside your circle of competence, no matter what the potential returns are.

Both Warren Buffet and Charlie Munger have famously stayed away from investing in businesses they don’t understand such as technology companies. When asked about why Berkshire doesn’t invest in technology firms, Buffet said, “I don’t worry about the things I miss that are outside my circle of competence of evaluating”.

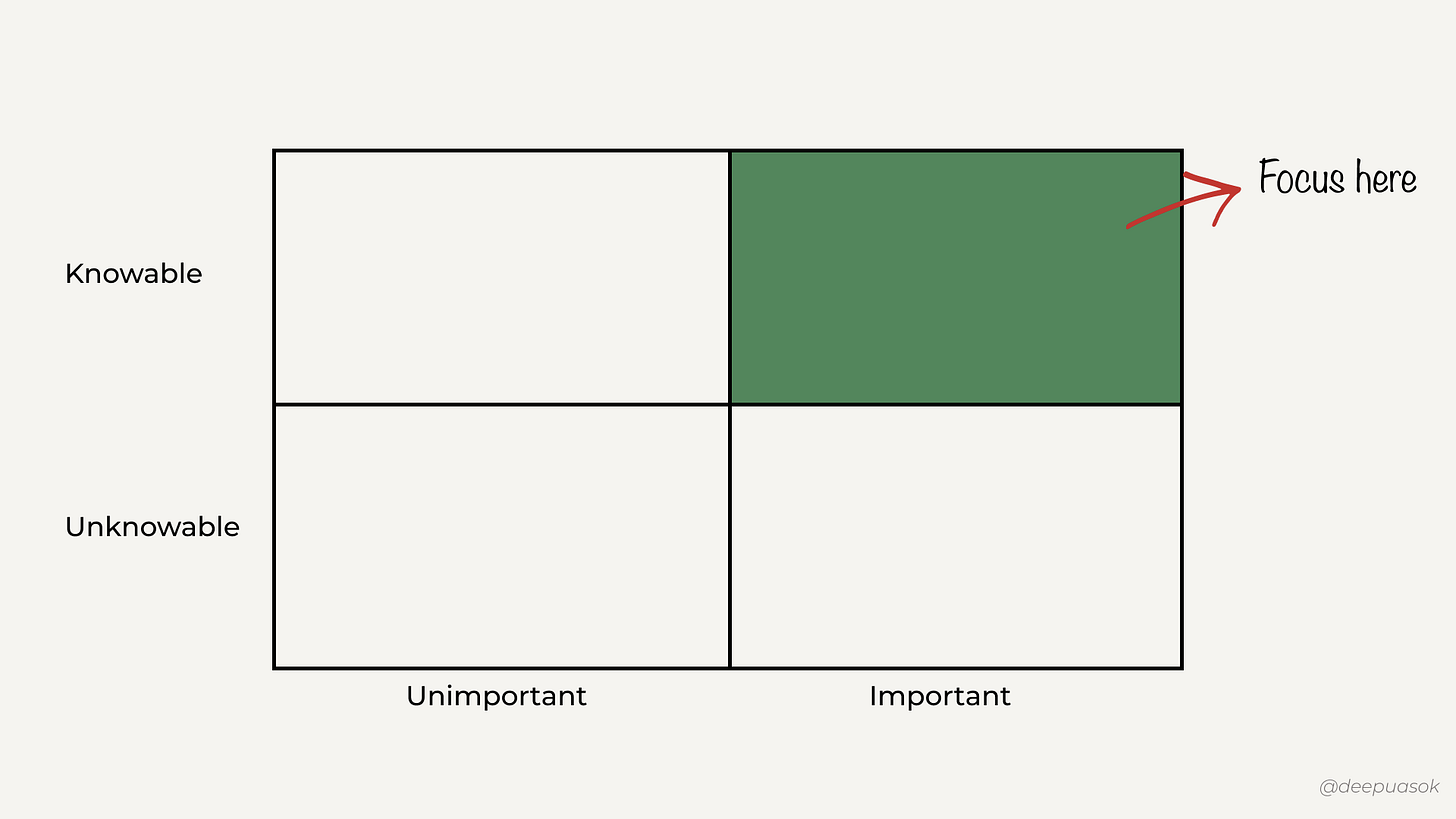

They choose to focus on the things that are important and knowable rather than worrying about the things that are important and unknowable.

Develop an area of expertise and stay within it.

Warren Buffet and Charlie Munger developed the mental model of the circle of competence as a filter to limit where they make their investments.

Their whole investment philosophy revolves around this core idea. In Berkshire’s 1996 annual shareholder letter, Buffet wrote:

Intelligent investing is not complex, though that is far from saying that it is easy. What an investor needs is the ability to correctly evaluate selected businesses. Note that word "selected": You don't have to be an expert on every company or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.

On another occasion, Munger wrote:

“The game of investing is one of making better predictions about the future than other people. How are you going to do that? One way is to limit your tries to areas of competence. If you try to predict the future of everything, you attempt too much.”

When I first heard about this mental model, it seemed too trite to warrant any further research. So I did the classic Charlie Munger move to understand a problem. I inverted it.

The Circle of Illusory Competence

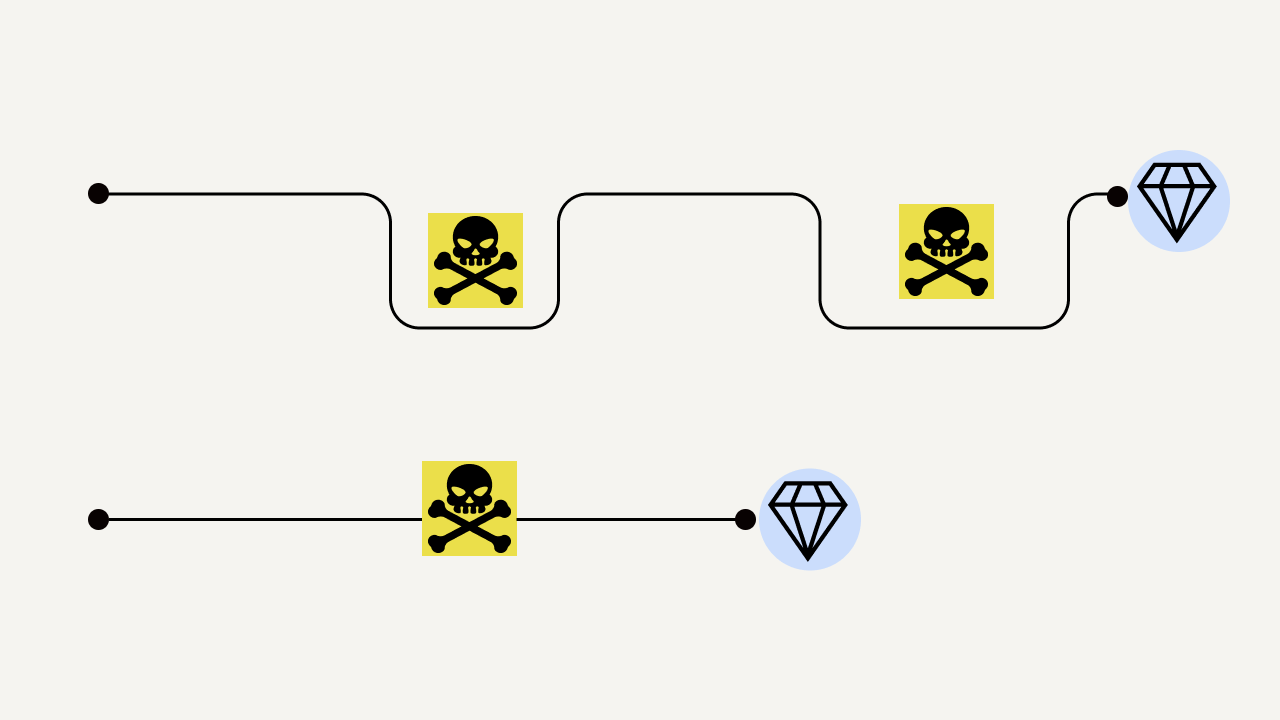

The real value of the circle of competence is only apparent when you invert the argument. The actual goal of staying in your circle of competence is NOT to maximize returns. It is to AVOID large losses.

The inverse of a circle of competence is the circle of illusory competence. When you have had a streak of wins, you start attributing it to your smartness.

Your overconfidence will then lead you to make bets in domains where you have no expertise whatsoever. Having the discipline to stay within your circle of competence prevents you from venturing into areas where you may encounter massive losses.

The circle of competence is about protecting against risk first and seeking returns second. For example:

If you want to be successful, you should try to avoid stupid decisions that may ruin your life.

If you want to be rich, you should try to avoid risky investments that could wipe out your wealth.

If you want to stay healthy, you should try to avoid unhealthy lifestyle choices that may lead to life-threatening outcomes.

In simple words, “Focus on things where you have some degree of confidence about the outcomes and avoid things where you don’t.”

It’s kind of incredible to think that the greatest investors of all time made it big by taking the unsexy route—staying away from risky and unknown bets and playing the long-term game.

The problem is that a lot of people are not very good at understanding the edge of their competence. They think they are too smart. So having the humility to take a good look at the edge of your competency is a trait worth developing.

As Richard Feynman famously said:

“The first principle is that you must not fool yourself — and you are the easiest person to fool.”

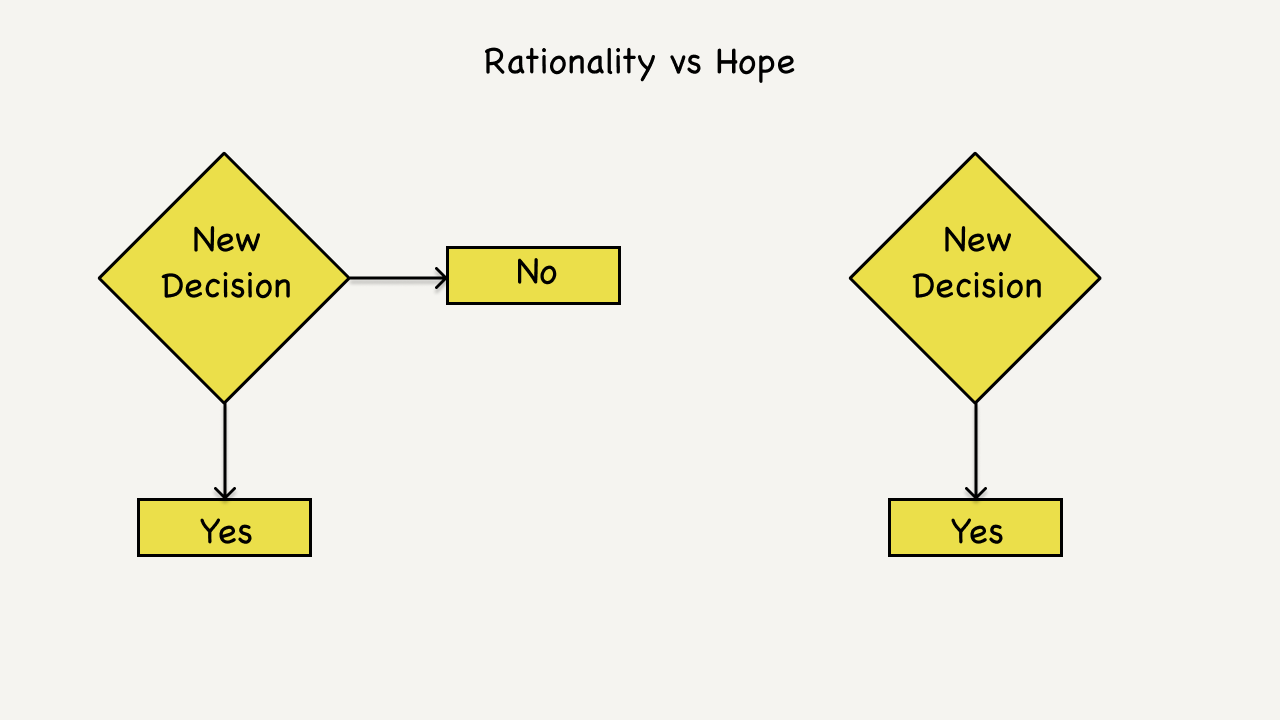

Strive for Rationality over Hope

The temptation for people to step outside of their circle of competence is hope. The hope that betting on new technology stock will get you huge returns. The hope that taking that new supplement will help you lose weight. The hope that switching to an entirely different career will change your life.

Buffet once remarked that the real danger of stepping outside your circle of competence is that you may find success a few times and be tempted to do more. As you may already know, Buffet is close friends with Bill Gates and he has a “pretty good” idea about Microsoft’s business model.

Yet, he consciously chooses not to step outside of his circle of competence. What he fears is that he might be tempted to step outside more if he gets a few of those bets right.

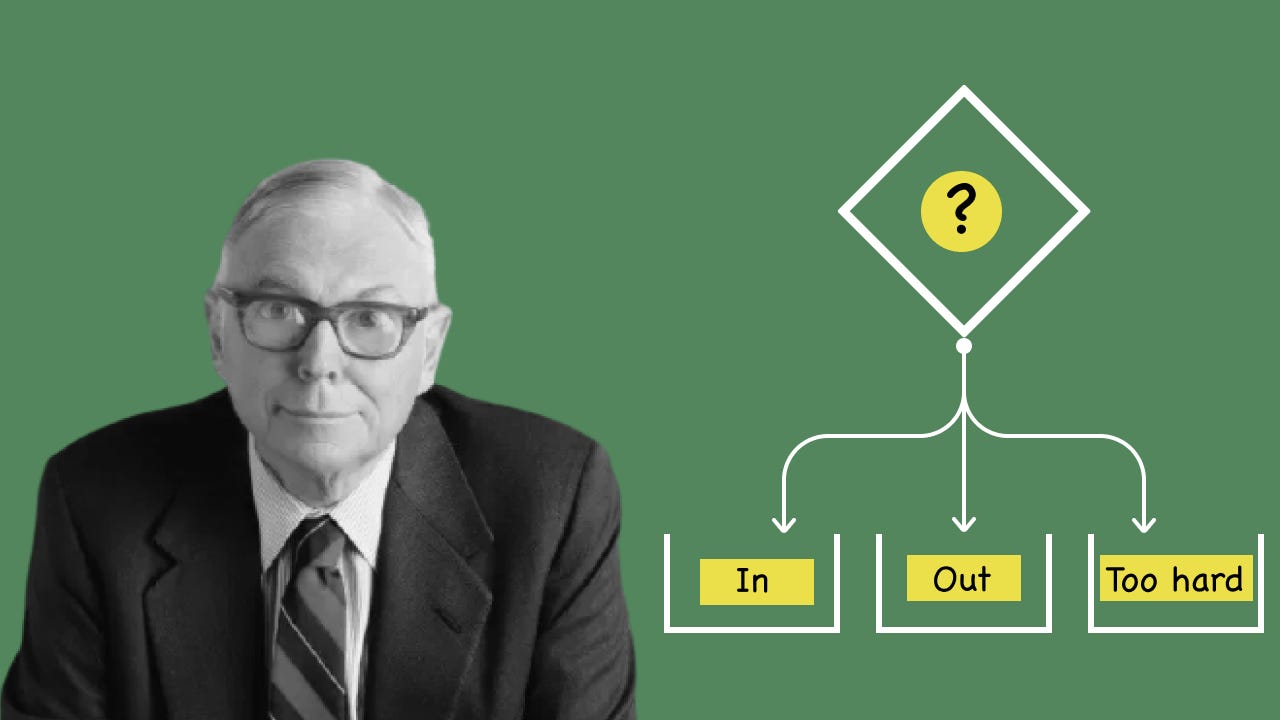

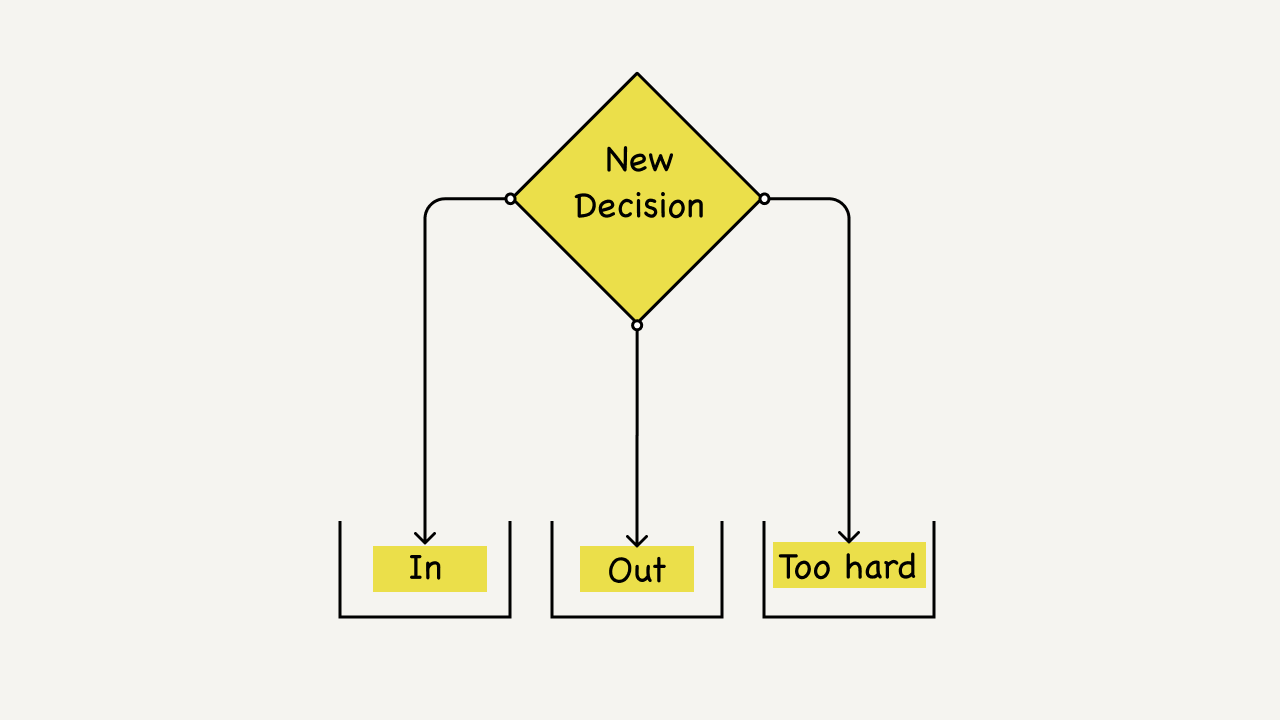

The Three Baskets for Decisions.

During an Annual Berkshire Meeting in 2002, Charlie Munger explained their actual filtering process, "We have three baskets: in, out and too tough...We have to have a special insight, or we'll put it in the "too tough" basket."

By forcing themselves to pass each and every decision through this main filter, they are able to avoid the natural human biases that may blind them to the risks. It becomes the main mental model that rules them all.

How to build your circle of competence.

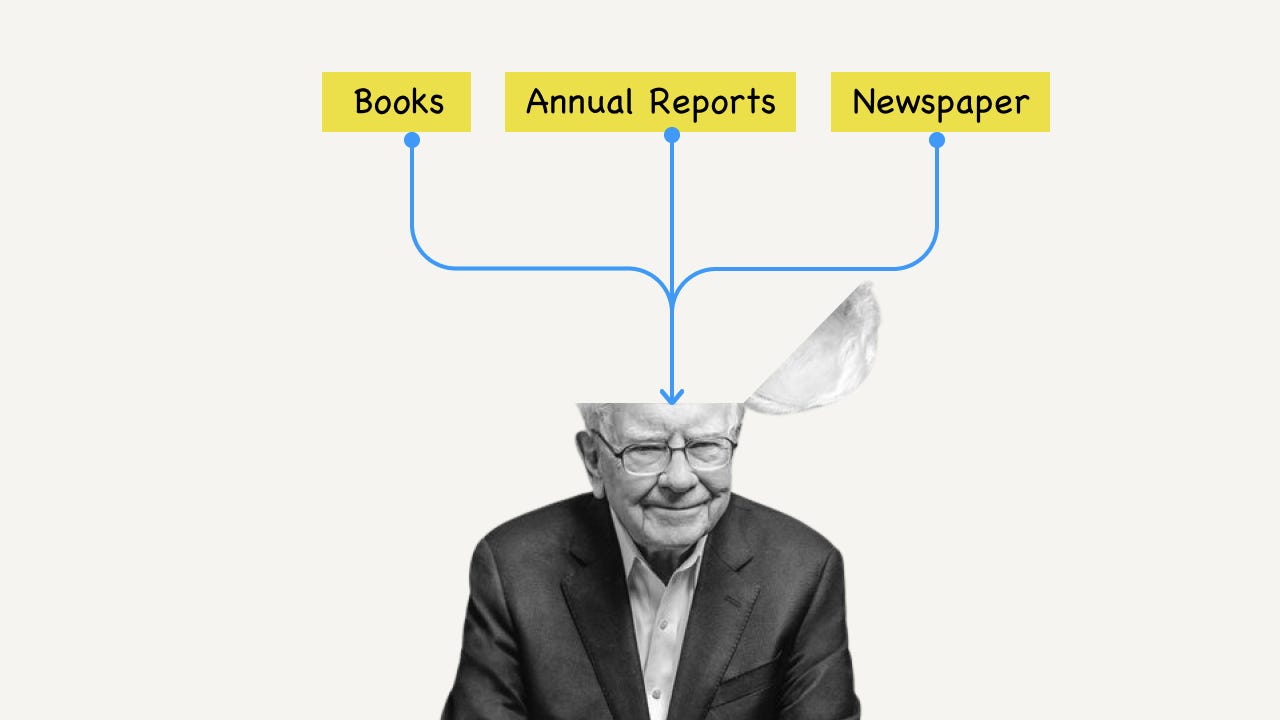

At one of the Berkshire annual meetings, Charlie said:

“Learning from other people’s mistakes is much more pleasant. The best way to do this is simple: When in doubt, read so you can learn vicariously."

He added, "We read a lot. I don’t know anyone who is wise who doesn’t read a lot.”

Reading is the single most high leverage activity to solidify the foundations of your circle of competence. Warren Buffet and Charlie Munger have shared that more than 70% of their time is spent on reading.

This habit has earned them the title of “learning machines”. They have an intense passion for learning new things and figuring out how things work in the world. Combined with a razor-sharp focus within their circle of competence, their competitors stand no chance of beating them.

Expand your circle of influence.

Now you might be thinking, "Does this mean that I am stuck in my domain? What if I want to explore a new career or business area?". The key idea that you need to understand is that expanding your circle of influence is difficult, not impossible.

For example, more than 90% of the people who enter the restaurant business fails. Most of them are started by people who made their money in some other field.

The root cause of their failure always lies in their false assumption that they know how the restaurant business works. The question they ask themselves is, "How hard could it be?". The real question that they should be asking is, “What do I not know about the restaurant business?”

Their overconfidence blinds them to the intricacies involved in operating outside of their circle of competence. However, if they would have worked hard enough, they could have learned those intricacies.

Applying the Circle of Competence

The circle of competence is not just a mental model for investing. It’s a mental model for operating in a world full of uncertainties. The fundamental philosophy behind this powerful model can be applied to any area of life.

In simple words, “Don’t take big bets in territories where the negative outcomes are unknowable and important”. Let’s take a look at a few examples in key areas of life.

Health

If you don't fully understand the side effects of that new nutritional supplement or diet, it' not worth taking the risk.

Relationships

If you don't know someone well enough to trust him with your business or life, it's not worth taking the risk of entering into a partnership with them.

Finance

If you don't know enough about an investment opportunity or asset class, then it's not worth betting your capital on it.

Career and Business

If you don't have a certain interest or special knowledge in a domain, it's probably not worth spending your life trying to succeed within that domain.

You have to figure out what your own aptitudes are. If you play games where other people have the aptitudes and you don’t, you’re going to lose. And that’s as close to certain as any prediction that you can make. You have to figure out where you’ve got an edge. And you’ve got to play within your own circle of competence.

-Charlie Munger

You may be better off trying to develop your circle of competence, however small it might be, in a domain where you have enough interest so that you can put in the hard work required to build deep expertise.

As Warren Buffet says, "If a massive loss is possible, it's simply not worth taking the risk". Instead, find a circle of competence where you can consistently make moderate amounts of returns and stay long enough in the game so that you start to see the effects of compounding.

As Confucious once said, “Real knowledge is to know the extent of one's ignorance.” It’s not an easy task but it’s totally worth it.

If you enjoyed this post, please consider sharing it with someone who would enjoy it.